66

2. have business activities that are highly sus-

tainable – all three of the examined compa-

nies generated continuously rising profit

margins over long periods of time

3. ensure that the essential components of their

value chain (innovation, research, produc-

tion, marketing and headquarters) are loca-

ted or take place at the company’s home

base of operations – all three of the exami-

ned companies produce and develop all es-

sential elements in Coburg

4. exploit international niches – all three com-

panies generate more than 65 % of their

turnover abroad

5. have strong ownership structures, often

being family-run – only Waldrich Coburg was

not family-owned but run by the Chinese

company Beijing No1

6. operate as the worldwide market leader or a

top three company in their respective indus-

try/niche – all of the Coburg companies are

worldwide market leaders in their niches.

Results

The following sections present the key fin-

dings of the two aforementioned studies, ana-

lysing in more detail the factors that contribu-

te to the increased levels of Chinese FDI in

Germany and Europe as a whole, as well as

the main drivers towards internationalization

and Mergers & Acquisitions of German small-

and medium-sized firms.

Reasons for Chinese-German Mergers &

Acquisitions

The results of the survey indicate that Germany

is clearly the most preferred investment choice

for Chinese investors by the survey group in the

categories of “Economics” and “Technology”

among the four selected countries and was

ranked very closely with UK in the “Political” di-

mension. As indicated in Table 1, Germany was

only ranked less favorable to the UK with re-

gards to “Culture”, most notably in the “Lan-

guage” category.

An additional major finding from the survey re-

sult was that both “Compatibility with Chinese

culture” and “Overall society feeling toward

for metal forming, powder metallurgy, building

materials (LASCO), precision centers and ma-

chines (Waldrich Coburg) and compressors,

compressed air products (Kaeser GmbH). Un-

like LASCO, Kaeser and most German Hidden

Champions, Waldrich Coburg is no longer a fa-

mily-run business, but was sold already in

1986 for the first time to the American milling

machine manufacturer Ingasoll, which was ta-

ken over in 2005 by the Chinese company Bei-

jing No1. Beijing No1 is wholly owned by Jing-

cheng Holding, which in turn is owned by

Beijing’s municipal government. Nonetheless,

all three companies exhibited a strong presence

in China and Asia as a whole.

The three companies were chosen as examples

because they exhibit all characteristics of a ty-

pical Hidden Champion in Germany – characte-

ristics that make them particularly attractive to

Chinese investors. In line with the definition of

Prof. H. Simon

30

, Hidden Champions tend to:

1.be located in smaller towns or on the out-

skirts of major regional centers – Waldrich

Coburg is for example located in Coburg, a

city of 40,000 inhabitants 90km away from

the regional center of Nuremberg, so to say in

the province

31

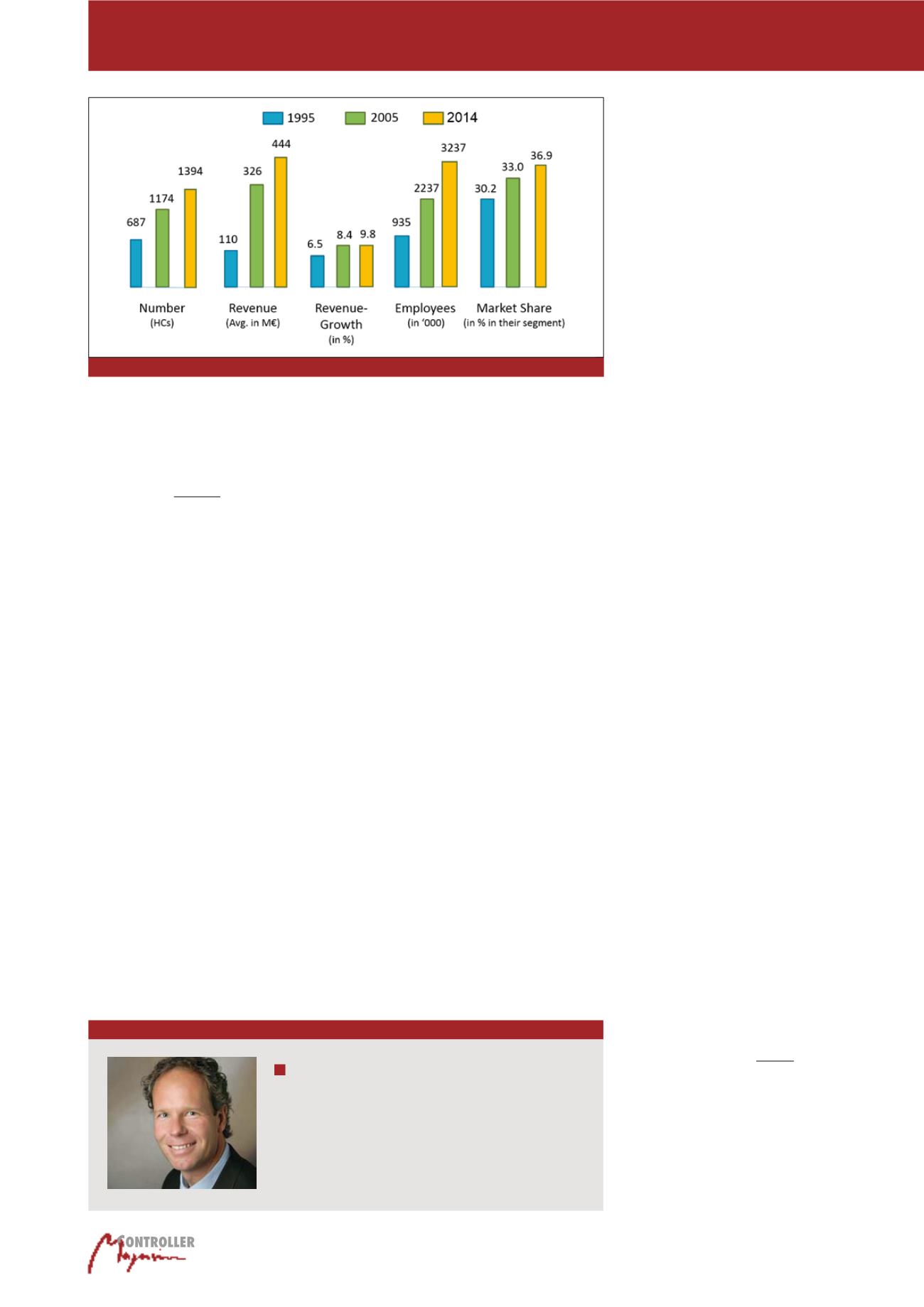

located in Germany (the highest national num-

ber of such companies in the world), that gene-

rate an average of over € 400 million euro an-

nually, achieving growth rates of almost 10%

each year (see Figure 6). Hidden Champions

can be considered major drivers in both the na-

tional and regional economies, with just 221

HCs generating for example 29% of the Bava-

rian GDP and employing 26% of the Bavarian

workforce.

28

In order to understand what makes Hidden

Champions in Germany so successful and in or-

der to determine why they are attractive targets

for Chinese M&As, a second study on the suc-

cess factors and mindset of the HCs was con-

ducted in parallel to the aforementioned survey.

The study aimed to not only find out what ma-

kes the Hidden Champions successful, but also

to examine the role that internationalization

plays for such companies. The three participa-

ting companies, LASCO Umformtechnik GmbH,

Waldrich Coburg GmbH and Kaeser GmbH are

worldwide market leaders in their respective in-

dustries and have had a track record of interna-

tional success for years. The companies opera-

te in sectors that have been the main target of

Chinese investments, particularly the produc-

tion of machines, tools, automation technology

Autor

Prof. Dr. Kai-Uwe Wellner

ist Professor für International Management an der Technischen

Hochschule Nürnberg Georg-Simon-Ohm, Faculty of Business.

E-Mail:

Figure 6: Development of Hidden Champions in Germany 1995-2014

29

Hidden Champions