65

factors. To each sub-factors, the survey parti-

cipants have to rate from 1 to 5, where 1 is the

most favorable and 5 is the least favorable

(favorable in terms of the benefit for the

purchaser). The survey with the Chinese ma-

nagers was conducted in the time period of 4th

December 2016 to 1st March 2017. The total

number of respondents was 32, originating

from a wide variety of senior managers in di-

verse sectors, including automobiles, high-

tech manufacturing, fashion and clothing, ban-

king, real estate, fund management and priva-

te equity. The stratified sampling method was

chosen, as the survey focused on the sample

population who are owners or directors of small

and medium companies or investment related

managers in large financial institutions and pri-

vate equity companies. This helped to filter the

sample population to the core group who has

the essential knowledge about M&A or could

be a potential investor in EU.

An analysis of three Hidden Champions

in Germany

A large number of Chinese investments have

targeted one of the most important growth are-

as of the German economy: Hidden Champi-

ons

26

. According to Hermann Simon

27

, Hidden

Champions (HCs) are medium-sized companies

that tend to be unknown to the general public,

yet act as the worldwide market leader or a top

3 supplier in their respective market niche. A

2014 study by the German Federal Ministry for

Science, Research and Economics revealed

that there are at least 1,394 Hidden Champions

Resarch Methodology

In order to fulfill the objectives of this study and

determine the stance of Chinese investors on

the business attractiveness of the four selected

countries (United Kingdom, Germany, France,

Netherland) within EU, the authors conducted a

questionnaire of the Chinese business commu-

nity and several potential investors in Europe.

A survey of Chinese investors in Europe

In the survey the authors have combined the

economic performance and business efficien-

cy in IMD World Competitiveness Yearbook

25

into an economic dimension, while government

efficiency and infrastructure were merged into

the political dimension. Two other dimensions,

culture and technology, were included in order

to show the non business related M&A factors.

In each dimension, there are three to four sub-

due to its highly attractive tax haven policies

and financial- and private equity investments

17

.

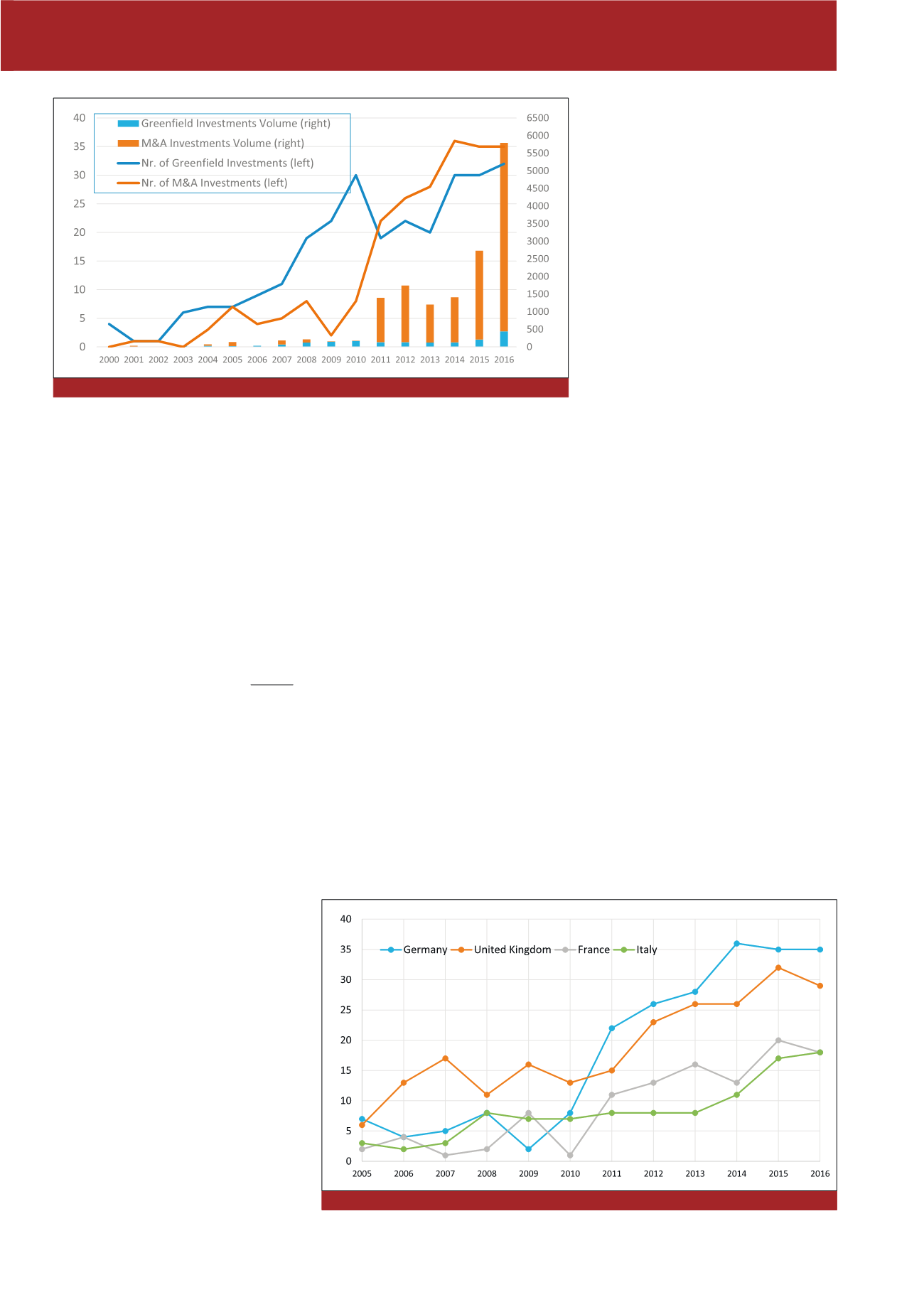

The figures for 2017 will indicate major increa-

se in volume for German OFDI from China and

a decrease due to Brexit insecurity in the United

Kingdom. The UK decrease will mainly be in

real estate investments, which are on the other

hand the strongest growth of Chinese OFDI in

Germany.

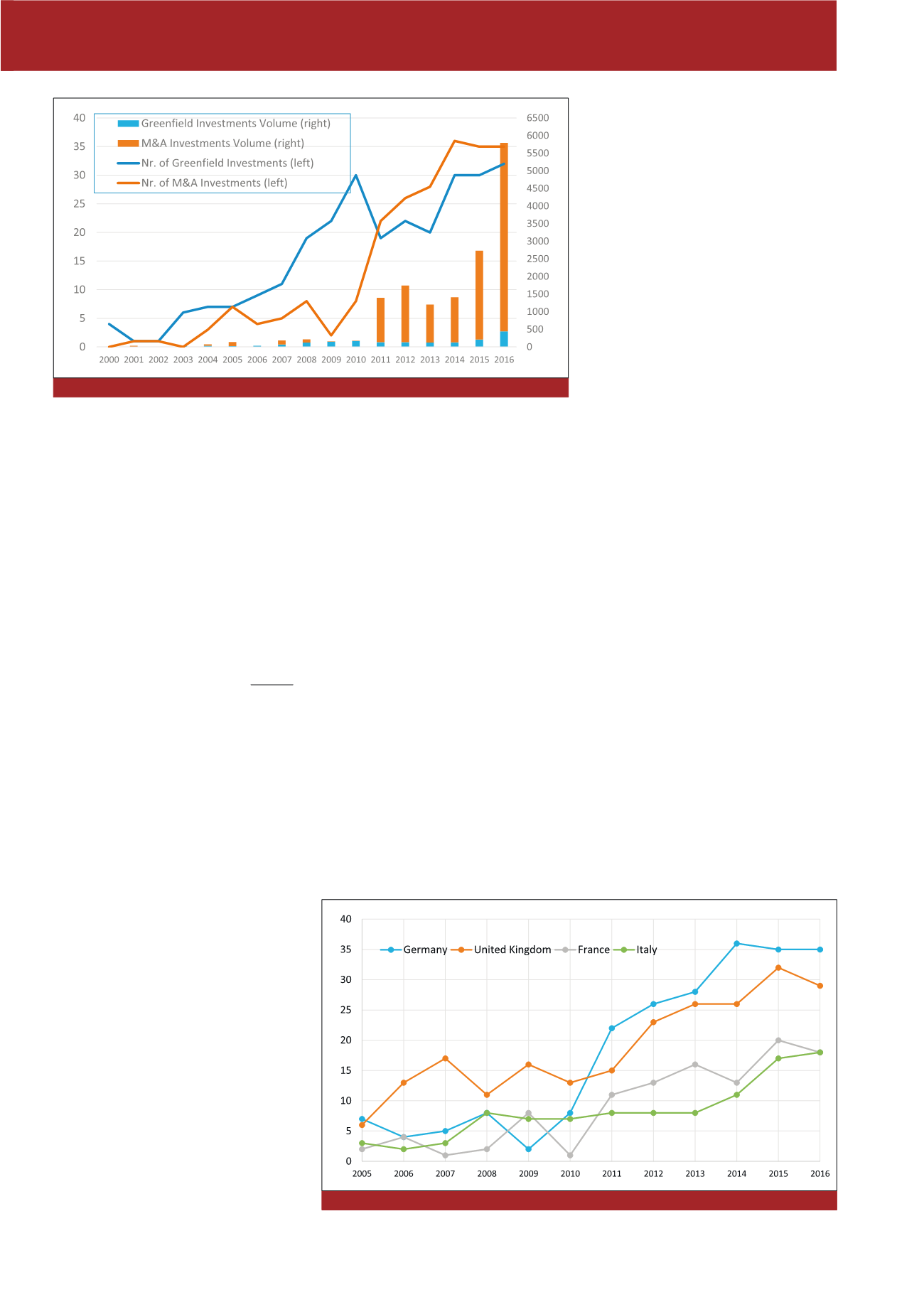

Since 2011, Germany has become the most

sought destination for M&A in the EU, attracting

the most M&A deals within the region (Figure 5).

Compared with investments into other target

countries, Chinese M&A investments into Ger-

many exhibit a more stable pattern, furthermo-

re benefiting from the diversified industry port-

folio and a strong German economic boost

since 2011. Notable M&A transactions in Ger-

many in 2016 and first half 2017 included the

purchases of EEW Energy, KraussMaffei, Bilfin-

ger Water Technology, Compo Consumer and

the Bigpoint GmbH.

18

According to a recent stu-

dy by PwC, key reasons for Chinese invest-

ments in German firms include market entry

(62%), the acquisition of new technology and

expertise (58%), branding (36%) and diversifi-

cation in general (17%).

As indicated by a recent PwC study, 65% of

Chinese investors in Germany are privately ow-

ned companies, with the remaining 35% ope-

rating under the control of the Chinese govern-

ment. In addition, more than half of the inves-

tors (62%) originate from the southern regions

of China, with only 36% and 2% of firms being

based in the northern parts and central or wes-

tern regions, respectively

24

.

Figure 4: Chinese OFDI investments in Germany 2000-2016

22

Figure 5: Number of Chinese M&A deals by country 2005-2016

23

CM September / Oktober 2018