40

GERMANY

ISSUE

I

RESIDENTIAL PROPERTIES

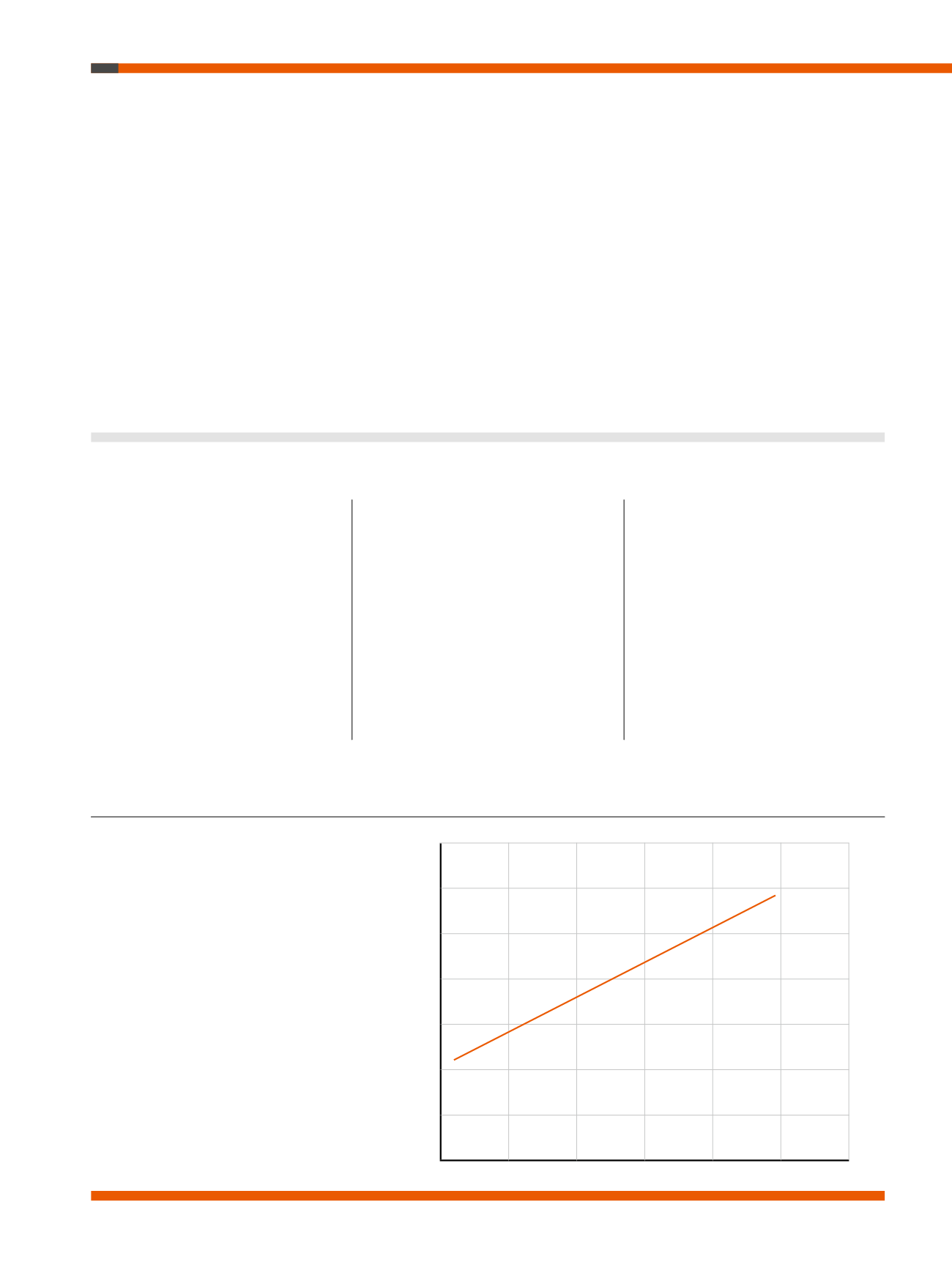

Risk

Return (% pa)

10

9

8

7

6

5

4

3

2

2,5

3

3,5

4

4,5

5

“smaller” big cities – because in addition

to the top seven, there are 73 other cit-

ies in the country with a population of at

least 100,000. These medium-sized cities

offer specific advantages of their own. The

market is subject to less price fluctuation,

and properties in excellent locations that

offer a quality comparable to that of large

cities can usually be acquired for an ap-

preciably better price. Although the rents

are frequently well below the levels seen

in the seven major cities, the smaller cities

generally offer higher returns at compara-

I

nvestors are still interested in German

(residential) real estate as Germany

continues to be regarded as a safe hav-

en regarding real estate investments. For-

eign and German investors tend to put

at least half of their total registered real

estate investments in the seven big prop-

erty hubs of Berlin, Cologne, Düsseldorf,

Frankfurt am Main, Hamburg, Munich

and Stuttgart. Thanks to its transparency

and volatility levels which remain low, the

real estate market in these cities ensures a

high degree of reliability when it comes to

Will Medium-sized Cities Soon

Overtake Major Cities?

Demand for residential real estate is particularly high in Germany. Major cities barely

offer any profitable investment opportunities nowadays. However there are still alternatives:

In German B cities attractive returns can still be generated with reasonable risk levels.

planning. In view of the extremely short

supply, however, investors will find that

the market will remain persistent and

strained in 2017 – despite higher levels

of construction activity. This means that

prices on the market will remain above

average at low entry-level returns. While

returns of more than 5% are still feasible

in Cologne, potential returns in Munich

are only 3.2% on average.

This makes the search for real estate

investments tougher this year, and forces

investors to broaden their scope to include

The chart compares the average returns that

can be generated in the respective markets to

the specific investment risk.

A simple trend line was calculated on the basis

of the analysed medium-sized cities with a

population of at least 100,000. For each city

featured, the difference between the return

and the average return for the respective risk

can be calculated. In general, the cities above

the trend line offer above-average returns in

relation to their specific risk, while returns are

below-average for cities below the line.

RISK-RETURN PROFILE

FOR RESIDENTIAL REAL ESTATE AT WÜEST PARTNER

Note: Returns correspond to the average gross returns in

the respective cities. Figures include both good properties

in average to prime locations as well as inferior properties.

The actual returns may deviate from the stated returns by

up to 200 basis points in the respective cities.

Source: Wüest Partner Deutschland

■

Berlin

Saarbrücken

■

■

Frankfurt/Main

■

Wuppertal

■

Coblenz

Brunswik

■

■

Kiel

Lübeck

■

■

Paderborn

■

Würzburg

■

Erlangen

■

Regensburg

■

Karlsruhe

■

Bonn

■

Ulm

■

Dresden

Potsdam

■

■■

■

Hamburg

■

Stuttgart

■

Düsseldorf

1

2

1 2

■

Munich

■

Cologne