23

Strong HCs

Regional HCs

Start-ups with

emerging competitive

advantage

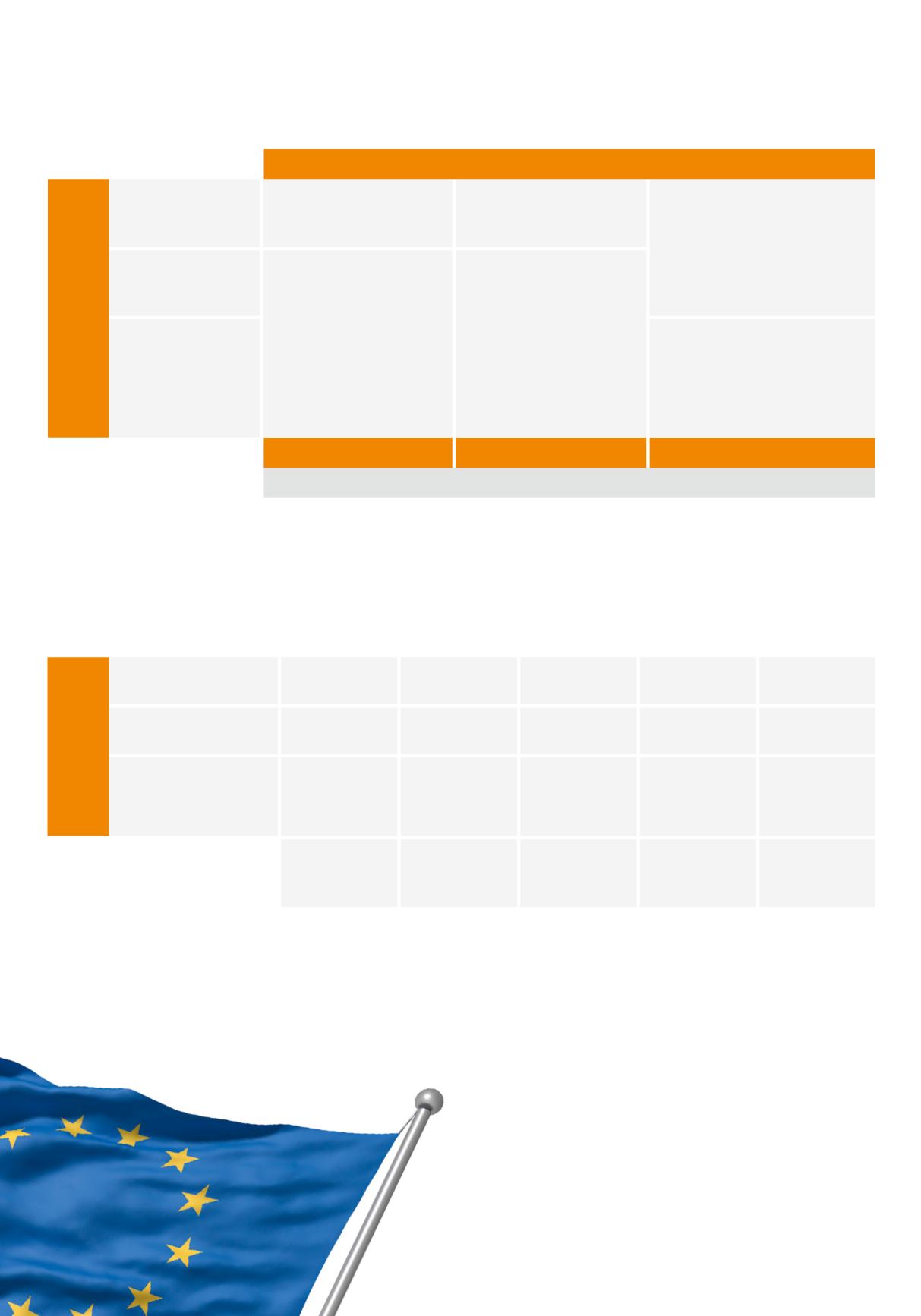

As growth and development require additional funds, a

closer look at how CEE’s hidden champions address the

challenge of nancing further growth and development is

insightful (Figure 2). A clear pattern here is that counting

Financial strategy dilemma of hidden champions attempts

to explain why neither debt nor external equity (including

private and public equity) are

“

suitable

”

sources of financing

for most of them. Financial strategy dilemma is the choices

that hidden champions must make when considering how

to nance their business. While nancial investors require

transparency and expect businesses to outline nancial,

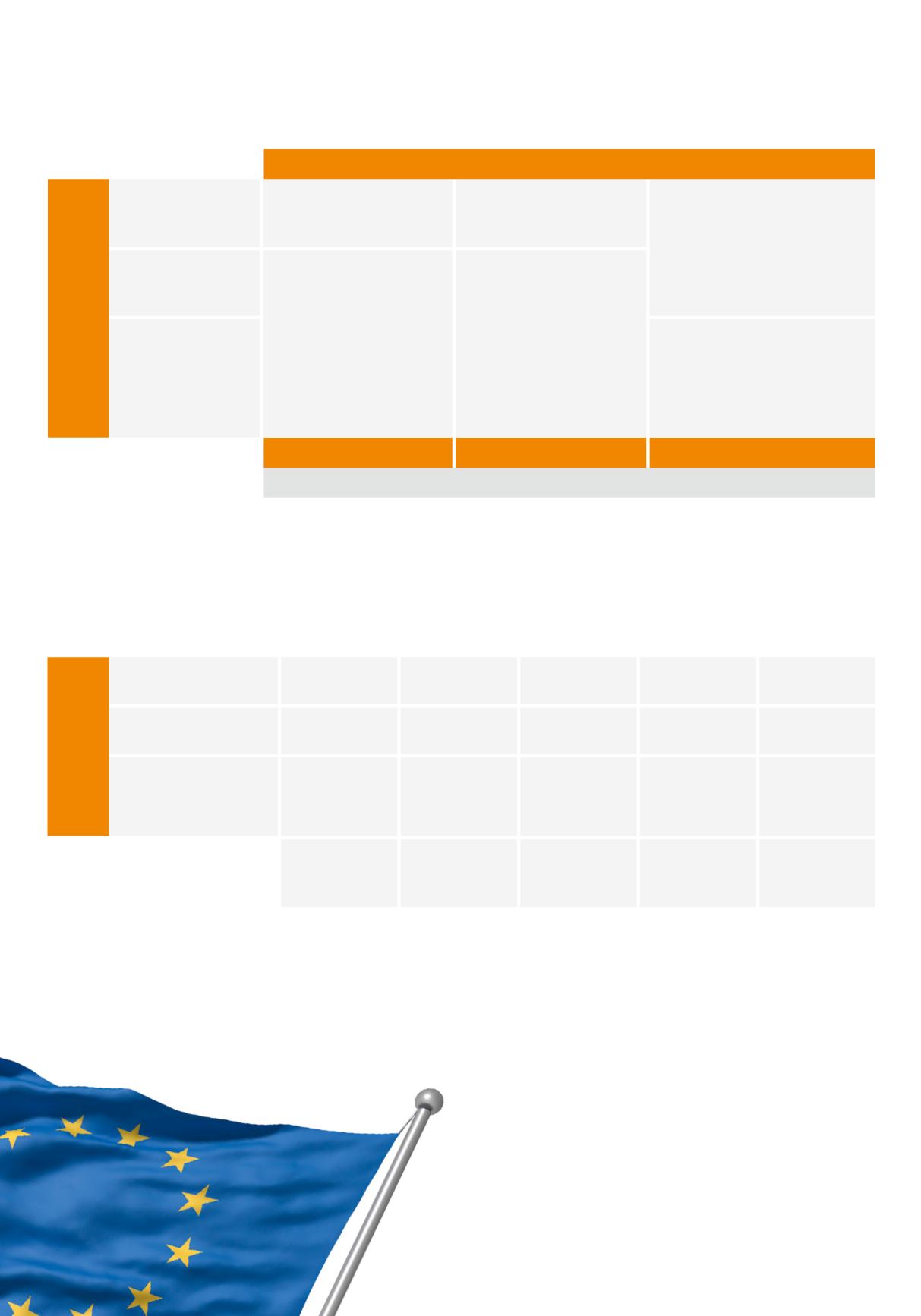

Tangible

assets

Social capital

and technology

Knowledge and

innovation

Privatisation of assets at a

symbolic price (mainly before

early 1990s, rarely

Amount of these assets is

insignificant for the HCs

originated in this decade

… – 1990

1990 – 2000

2000 – …

Capturing technology,

monetising and

commercialising social

capital and technology

(mainly mid 1990s – 2000s,

rarely early 1990s)

Amount of these assets is

insignificant for the HCs originated

in this decade

Self-finance, no big initial

investments required;

Trade finance from a big

customer

Amount of these assets is

insignificant for the HCs

originated in this decade

Fig. 1 How hidden

champions from CEE

initially obtained funds

on themselves proves to be the most effective financing

strategy, while external debt and equity financing seems to

be rather an exception than a rule.

strategic, and business model issues explicitly, which may

act to commoditise and devalue key success factors of a

mainly intangible nature, strategic investors require their

share of control, reducing and thus devaluing the initial

owner’s leadership and personality roles. Either way, a very

important strategic advantage is being destroyed.

For many hidden champions seeking the right financial

sources, rethinking their approach to management may be-

come crucial, requiring a focus on formalisation of strategic

process, risk management, and implementation of sound

corporate reporting practices. Learning how the language of

globalised financial markets will influence the functioning of

these unique companies is worth further study.

Yes

Yes

Yes

Self-financing

Yes

Yes

Yes

Trade financing

and partnerships

Yes

Rare

Exceptionally rare

Debt financing

(Loans)

Exceptionally rare

Exceptionally rare

No

External equity

financing

Rare

Exceptionally rare

No

Debt financing

(Bonds)

Fig. 2 How hidden

champions in Central

and Eastern Europe

finance their growth

MAIN TYPE OF

Assets of certain type initially financed by

Period of company origination

TYPE OF HC